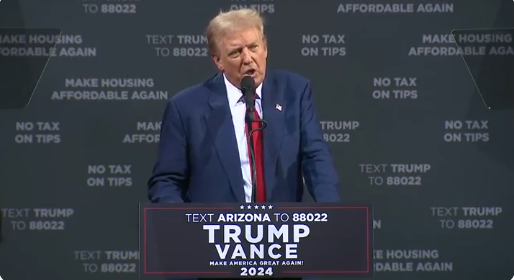

Donald Trump stood before the crowd in Tucson, Arizona, under the desert sky, making a pitch that immediately caught the attention of many in attendance. His promise? To eliminate taxes on overtime wages for individuals clocking in over 40 hours a week. The former president called it a break—something working-class Americans needed, in his words, for a long time.

“I’m announcing today—right now—that part of our plan includes cutting all taxes on overtime pay,” Trump said, leaning into his familiar cadence. “Think of what that means. It’s more money in your pocket, a reason to work harder… and companies will have an easier time finding people who want to put in those extra hours.” The promise hung in the air, bold and simple, a crowd-pleaser for sure. His words painted a vision of a workforce revitalized, energized, all because the taxman wouldn’t be taking a piece of their overtime anymore.

President Trump just announced that as part of his tax cuts, there will be no taxes on overtime work.

But muh TV told me that Trump is only cutting taxes for the rich!!!

This guy is truly a man of the people! 🇺🇸 pic.twitter.com/6uvksxKVyZ

— TheStormHasArrived (@TheStormRedux) September 12, 2024

Trump didn’t delve into the finer details of how he’d make it happen—Congress, after all, has the final say in such matters. But his message was clear: work harder, keep more of your money. He praised those in professions that often find themselves burning the midnight oil—nurses, truck drivers, factory workers, police officers. These were the people, he said, who needed that extra financial cushion the most, and Washington had been turning a blind eye for too long.

While his vision stirred excitement, the mechanics of such a policy would be a different story. As it stands, overtime income falls into the same tax category as regular wages under the Fair Labor Standards Act. Changing this, shifting the structure, wouldn’t be something he could just wave into existence—it would need serious backing in Congress. But Trump wasn’t focused on legislative logistics in that moment—his sights were set on casting a future where the worker had more breathing room.

During the same rally, Trump leaned into other familiar promises—pledges he had brought up in the past, like ending taxes on tips and removing taxes on Social Security benefits for retirees. He framed these proposals as relief measures for those who, in his eyes, had been left behind by a system that constantly took without giving back. Under current tax law, tips are categorized as regular income, subject to taxation, and for those retirees with a certain level of income, Social Security benefits can also be taxed.

Trump’s message was all about scrapping that… tearing down the parts of the tax code that he argued punished the everyday worker. “This is what we need to do,” he told the crowd, “and we’re going to do it as soon as we’re back in office.”

Of course, tax policy changes don’t happen overnight. And they don’t happen without consequences. Economists have already started analyzing what these sweeping changes could mean, with groups like the Tax Foundation projecting that Trump’s broader tax cuts would reduce federal revenue by trillions over the next decade. It’s a delicate balance—cutting taxes in one area, but potentially replacing that loss with changes elsewhere, like tariffs, which could impact the economy in ways not immediately obvious to the average voter.

In case you weren’t watching Trump just announced that he will also be cutting overtime taxes! Along with his promise to stop taxing Social Security and no tax on tips, he will also bring no tax on overtime hours because after working that many hours, deserve to keep your money! pic.twitter.com/21e9uDbZeX

— Felecia Kay (@felecia_hicks94) September 13, 2024

Trump’s rally in Tucson wasn’t the first time he had floated such ideas, and it likely won’t be the last. The promises, simple in their appeal, resonate deeply with certain segments of the population. Workers who spend countless hours beyond the regular workweek want to feel like they’re not being shortchanged by the system. And in Trump’s telling, they’re not just getting their paychecks—they’re getting justice.

Vice President Kamala Harris, meanwhile, has proposed similar reforms, particularly focusing on Social Security benefits and tips. But while her approach also looks at tax relief for certain groups, her broader tax policies aim to raise substantial revenue through corporate and individual taxes. The economic tug-of-war is evident. On one side, promises of more take-home pay for the working class. On the other, concerns about how to pay for it all and what it means for the economy in the long term.

For Trump, the message was simple—give people more of what they’ve earned and cut out the unnecessary taxes. Whether he’ll have the chance to follow through on this bold vision remains to be seen, but the rally in Tucson made one thing clear—he’s banking on the promise of financial relief to win back the hearts of the American worker.

Major Points

- Donald Trump promised to cut all taxes on overtime wages, aiming to boost working-class incomes and incentivize extra work hours.

- The plan targets professions like nurses, truck drivers, and police officers, giving them a bigger financial cushion for overtime efforts.

- Trump also reiterated past proposals, including ending taxes on tips and removing taxes on Social Security benefits for retirees.

- Economists warn that such sweeping tax cuts could reduce federal revenue by trillions over the next decade, raising concerns about how to offset the financial impact.

- Vice President Kamala Harris has proposed similar reforms, but her broader tax plan includes raising revenue through corporate and individual taxes, reflecting contrasting economic strategies.

Kirk Volo – Reprinted with permission of Whatfinger News